tax ny gov enhanced star

There are two types of STAR exemptions. Enhanced Star must be renewed each year.

Tax Exemptions Town Of Oyster Bay

NEW STAR applicants must register with NYS Tax Department at 518 457-2036 or visit them at wwwtaxnygovstar.

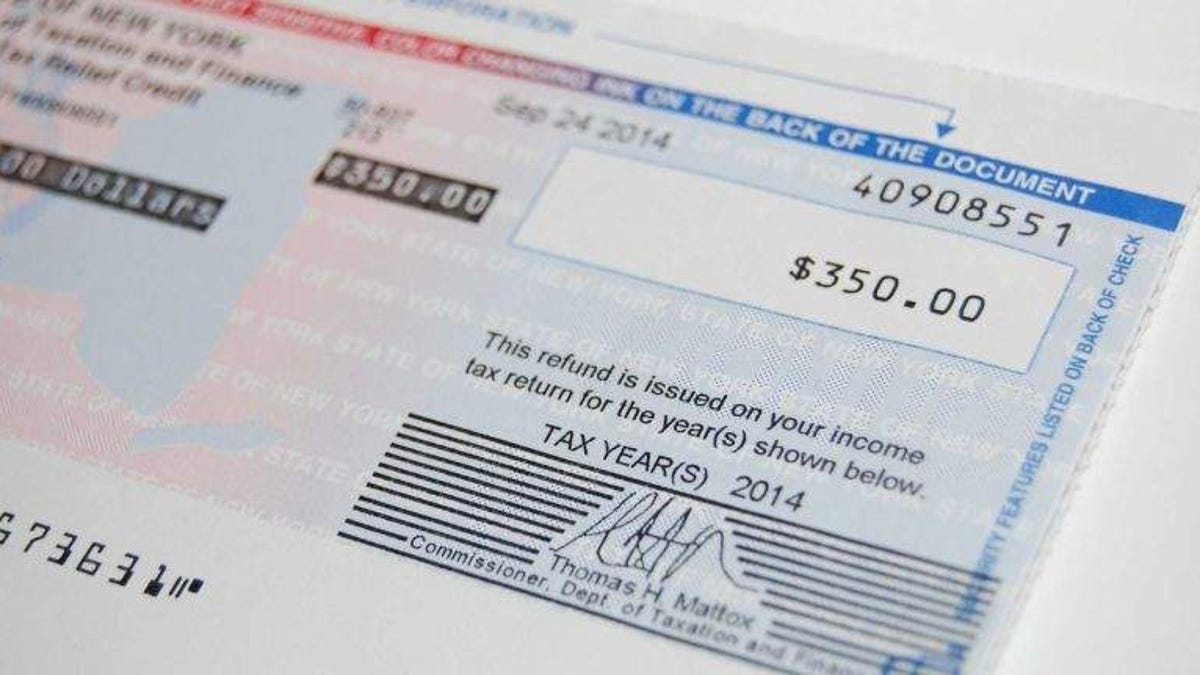

. Basic and Enhanced STAR Exemption New STAR applicants will receive a check from New York State instead of a reduction on the school property tax bill. The New York State Department of Taxation and Finance today reminded seniors that for most localities the deadline to apply for greater property tax savings through the Enhanced STAR property tax exemption is March 1. When you apply for the Enhanced STAR exemption with your assessor along with submitting Form RP-425-IVP and Form RP-425-E you must also provide the assessor with Form RP-425-Wkst Income for STAR Purposes Worksheet.

The School Tax Relief STAR and Enhanced School Tax Relief E-STAR benefits offer property tax relief to eligible New York State homeowners. To qualify for the Basic STAR exemption the home must be the owner-occupied primary residence where the combined income of the owners and. As long as you.

WITH THE TOWN OF BROOKHAVEN DO NOT FILE THIS FORM YOU MUST REGISTER WITH THE. To be eligible for the 2022 Enhanced STAR property tax exemption seniors must. What is Enhanced STAR.

RP-425E 202 23 ENHANCED STAR APPLICATION. There is no age requirement. Who Can Apply Homeowners not currently receiving the STAR exemption who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and Finance.

Star exemption information basic star exemption and star enhanced exemption beginning in 2016 any homeowner who is applying for the first time on a property meaning you have never had any star exemptions on your property before or you are a new homeowner of a property is required to register with new york state department of taxation and finance. Ad Download Or Email NY RP-425 More Fillable Forms Register and Subscribe Now. The following security code is necessary to prevent unauthorized use of this web site.

Enhanced STAR is a school property tax benefit that saves most senior homeowners in New York State hundreds of dollars each year. RP-425-MBE 122 wwwtaxnygov Property key. Have one owner of the property who will be at least 65 years of age.

The Basic New York State School Tax Relief STAR and the Enhanced School Tax Relief ESTAR exemptions reduces the school tax liability for qualifying homeowners by exempting a portion of the value of their home from the school tax. Yes No Yes No Yes No Yes No Spouse Siblings Who can apply. Co-ops Only Management Company.

The Basic STAR exemption is available to all eligible homeowners with incomes below 250000 regardless. You may be eligible for an Enhanced STAR exemption The STAR program provides eligible homeowners with relief on their school property taxes. STAR is the New York State School Tax Relief Program that provides a partial exemption from or credit for school property taxes for owner-occupied primary residences of one two and three-family homes farm homes condominiums cooperative apartments or multiple-use properties of which a portion is used by the owner as a primary residence.

Homeowners not currently receiving STAR who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and Finance. IF YOU ARE NOT CURRENTLY RECEIVING THE STAR EXEMPTION. Enter the security code displayed below and then select Continue.

Enhanced STAR is available to senior citizens age 65 and older who own and live in their primary residence and who meet certain income requirements see below. Current income limits are based on the 2020 income tax year and your adjusted gross income cannot exceed 92000. Register with the NYS Tax Department at wwwtaxnygovstar.

Several years ago New York State. Enhanced STAR application form RP-425E. NYS DEPARTMENT OF TAXATION FINANCE 518-457-2036 OR WWWTAXNYGOVSTAR INSTRUCTION SHEET.

The first year the assessor will use the information you provide to determine whether your income qualifies for the exemption. If you are using a screen reading program select listen to have the number announced. Basic STAR recipients who are eligible for Enhanced STAR.

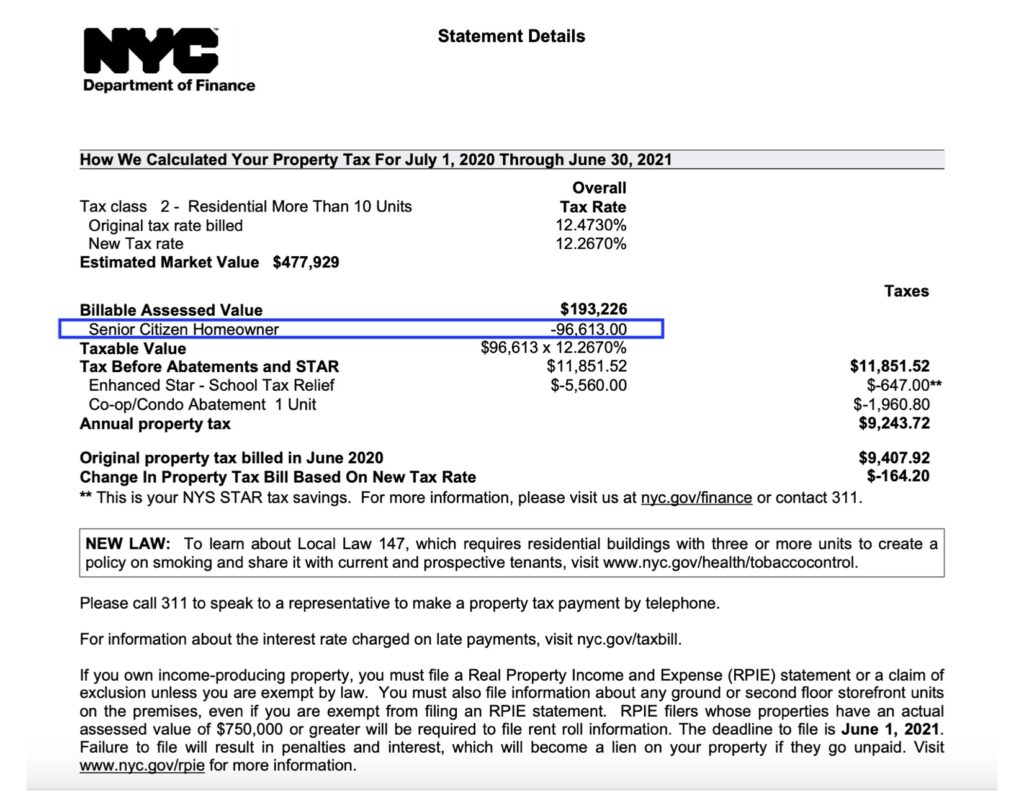

This requirement applies to property owners who received Basic STAR benefits and are applying for Enhanced STAR and those already receiving Enhanced STAR benefits but who did not register for the Income Verification Program IVP. The New York State Department of Taxation and Finance will annually determine income eligibility for qualifying Enhanced STAR applicants. The Enhanced STAR exemption provides an increased benefit for the primary residence of a senior citizen age 65 and older who has a qualifying 2020 income of less than 92000.

If you are a new homeowner or first-time STAR applicant you may be eligible for the STAR credit. For a list of who else should use this form see the instructions on page 2. If you have signed up for the automatic income verification program you must file NYS Income Taxes to do this you do not have to file a renewal application with the Assessor as long as NYS Taxation Finance can.

Who is eligible for Enhanced STAR. This application is for owners who had a STAR exemption on the same property in the 20152016 tax year and wish to apply for Enhanced STAR. A reduction on your school tax bill.

You can receive the STAR credit if you own your home and its your primary residence and the combined income of the owners and the owners spouses is 500000 or less. Page 2 of 2 RP-425-B 821 Instructions General information The Basic STAR exemption reduces the school tax liability for qualifying homeowners by exempting a portion. New York State revised the filing and approval procedure for all Enhanced STAR applications beginning in the 201920 tax year December 2019 to November 2020 tax bill.

A copy of your latest Federal or State Income Tax Return deed and drivers license must be submitted along with a complete and signed. You may be eligible for E-STAR if all owners of the property are 65 by December 31 2020. If youve been receiving the STAR exemption since 2015 you can continue to receive it for the same primary residence.

With Basic STAR exemptions who wish to apply and are eligible for the Enhanced STAR exemption.

Enhanced Star Income Verification Program Ivp Enhancement Stars Income

The School Tax Relief Star Program Faq Ny State Senate

Receiver Of Taxes Town Of Oyster Bay

What Is The Enhanced Star Property Tax Exemption In Nyc Hauseit

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Village Tax Information Ossining Ny

What Is The Nyc Senior Citizen Homeowners Exemption Sche

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times